Title: Cournot's Duopoly Model: An Analysis of Interdependent Oligopoly Behavior

Introduction:

Cournot's Duopoly Model is a fundamental economic model that

analyzes the behavior and outcomes of firms operating in a duopoly, where two

firms compete with each other in a market. This model, developed by French

economist Antoine Augustin Cournot in 1838, provides insights into the

strategic decision-making process of firms and the resulting market equilibrium

in oligopolistic settings. The Cournot model offers a valuable framework for understanding market dynamics and pricing strategies in various industries by considering the interdependence between firms.

Assumptions of the Cournot's Duopoly Model:

Two Firms: The Cournot model focuses on a specific type of

oligopoly involving two firms or players operating in the market.

Quantity Competition: The firms compete by choosing the

quantity of output they will produce rather than setting prices directly.

Simultaneous Decision-Making: The firms make their production

decisions simultaneously, without knowledge of the other firm's choice.

Constant Marginal Cost: The firms have constant marginal

costs, implying that the cost of producing an additional unit remains the same

regardless of the level of output.

Model Framework:

Demand Curve: The market demand is characterized by a

downward-sloping curve, which shows the relationship between the price of the

product and the quantity demanded. The total quantity demanded in the market

decreases as prices increase.

Firm's Profit Maximization: Each firm aims to maximize its

profit by selecting the quantity of output that will generate the highest

profit given the market conditions.

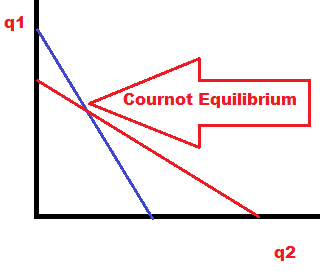

Reaction Functions: Firms consider their competitor's output

levels when deciding on their own quantity of production. This interdependence

is captured through reaction functions, which represent the relationship

between a firm's output and its competitor's output.

Market Equilibrium: The market equilibrium occurs when both

firms' chosen output levels satisfy the conditions of profit maximization,

taking into account the anticipated reaction of the competitor. At equilibrium,

neither firm has an incentive to unilaterally change its output quantity.

Implications and Insights:

Output Determination: The Cournot model reveals that firms

will choose output quantities lower than what would be expected under perfect

competition but higher than under a monopoly. Each firm recognizes that its

output affects the market price and considers the competitive response from the

rival firm.

Market Power: The Cournot model demonstrates that

duopolistic firms possess some degree of market power. While they compete with

each other, they have some control over the market price by adjusting their

output levels.

Collusion and Cooperative Behavior: The model also

highlights the potential for collusive behavior between firms, where they

cooperate to maximize joint profits. If the firms can coordinate their actions,

they may be able to achieve higher profits compared to non-cooperative

outcomes.

Extensions and Generalizations: Over time, the Cournot model

has been extended and generalized to incorporate additional complexities, such

as multiple firms, differentiated products, and sequential decision-making.

Let's consider an example of Cournot's duopoly using a

hypothetical market of smartphone manufacturers, Firm A and Firm B.

Assumptions:

Only two firms, Firm A and Firm B, operate in

the market.

Both firms produce identical smartphones with the same cost

structure.

The market demand for smartphones is given by the inverse

demand function P(Q) = a - bQ, where P represents the price and Q is the total

quantity of smartphones sold in the market. The parameters a and b determine the

demand curve.

Parameters

Both firms have a constant marginal cost (MC) of producing

smartphones, which we assume to be $200 per unit.

Decision-making:

Firm A and Firm B simultaneously decide how many smartphones

to produce based on their profit maximization objective.

Let's say the demand function for smartphones is given by

P(Q) = 1000 - Q, where Q represents the total quantity of smartphones produced

by both firms.

Step 1: Reaction Functions

Each firm determines its optimal quantity by considering the

anticipated reaction of the other firm. The reaction function for Firm A can be

represented as:

QA = (P(Q) - MC) / 2

Similarly, the reaction function for Firm B is:

QB = (P(Q) - MC) / 2

Step 2: Equilibrium Quantity Calculation

To find the equilibrium quantity, we substitute the demand

function into the reaction functions:

QA = (1000 - Q - 200) / 2

QA = (800 - Q) / 2

QA = 400 - Q/2

QB = (1000 - Q - 200) / 2

QB = (800 - Q) / 2

QB = 400 - Q/2

To find the equilibrium, we set QA equal to QB:

400 - Q/2 = 400 - Q/2

Simplifying the equation, we get:

Q/2 = Q/2

The equilibrium quantity for both firms is Q = 400.

Step 3: Price Calculation

To determine the equilibrium price, we substitute the

equilibrium quantity back into the demand function:

P(Q) = 1000 - Q

P(400) = 1000 - 400

P = $600

Therefore, the equilibrium price in this Cournot duopoly

example is $600.

Step 4: Firm's Profits

Finally, we can calculate each firm's profits at the

equilibrium. Since both firms have the same cost structure, their profits can

be determined using the profit function:

Profit = (P - MC) * Quantity

Profit A = (600 - 200) * 400

Profit A = $160,000

Profit B = (600 - 200) * 400

Profit B = $160,000

Both Firm A and Firm B would earn a profit of $160,000 at

the equilibrium quantity.

This example illustrates how two firms, operating in a

Cournot duopoly, determine their optimal quantities to maximize profits based

on their anticipation of the other firm's behavior. The interplay of these decisions determines the equilibrium quantity and price, leading to the

final outcomes in terms of profits.

Conclusion:

Cournot's Duopoly Model provides valuable insights into the

strategic behavior of firms in a duopoly setting. By considering the

interdependence between firms' output decisions, the model allows for a deeper

understanding of market dynamics, pricing strategies, and the implications of

different competitive scenarios. While the model focuses on a specific

oligopolistic structure, it serves as a foundation for more complex models that

explore a broader range of market situations and strategic interactions among

firms.