Quantity Theory of Money:

According to the economic theory known as the "quantity theory of money," a currency's value is based on how much of it is in circulation. The basic purpose of this theory is to establish how much money we should put into an economy at any particular time so it can run correctly without producing inflation or deflation. We have employed this theory in many countries, including USA and China, where its core notion has been implemented as well to construct its monetary policy.

We will provide a summary of Fisher's quantity theory of money in this post.

The quantity theory of money is a theory in economics that explains the determination of the value of money by its quantity. The quantity theory of money asserts that the value of any currency relies on how much it can be traded for, or used to acquire other products and services. It also states that if more units are available, their exchange rate will increase and vice versa. According to this hypothesis, a rise in demand for a currency would increase its price since more people desire to hold it as contrasted to other currencies with less demand.

We classified the quantity Theory of Money based on classical, neoclassical, Cambridge, and Keynesian as :

Fisher's Transactional Method

Approach to Cambridge Cash Balances

Quantity Theory of Money by Friedman

Keynesian Economic Theory

Fisher's Transaction Approach:

Italian economist Davanzati originally proposed the quantity theory of money. Renowned American economist Irving Fisher later made it popular in his book "The purchasing power of money," which was released in 1911 AD.

Fisher stated, "Other things being equal, when more money is in circulation, prices rise in direct proportion, while the value of money falls, and vice versa."

He put up the following presumptions to back up his theory:

- The total number of transactions (T), the speed at which money circulates (V), and the price level (P) remain unchanged.

- There is no system of bartering; money is merely a medium of trade, used exclusively for the acquisition of products and services.

- Because all the resources in the economy are being used to their full potential, the total number of transactions (T) is constant.

- Price level (P) is a passive component since other things affect it, but it has no independent influence.

- The amount of money M and the amount in the bank, M', are always related. The proportion of credit to cash does not change.

- In the long term, there is complete employment.

- Money is always in high demand.

- Business operations continue unabated.

- Money for credit is always available.

- Money should continue to move at the same rate.

- There is no money hoarding, meaning that the entire salary is spent rather than retained in savings.

The "equation of exchange," developed by Irving Fisher, was a mathematical representation of the link between the amount of money and the level of prices. For this, he gave the concept of the velocity of money. The velocity of money is a measure of the amount of money in circulation during a period. The velocity monitors how much money is changing hands and how rapidly it changes hands. It also displays the percentage change between periods and can be used to evaluate if any changes in the economy might imply inflation or deflation.

If we deal $10 with five times, the total amount of money in the transaction is $50, but the velocity of money is just 5. Thus, the velocity of money tells us whether the economy is shrinking or growing.

Thus, Fisher's equation of exchange is :

M = Money supply

V = Velocity of money

T = Total amount of transaction

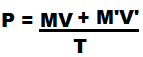

The money supply and velocity of money in the bank could not be covered by PT = MV. So, M' and V' are included in the above equation and rewritten as:

Where M' is credit money and V' is the velocity of credit money created by banks.

Because it is practically impossible to determine the complete number of economic transactions, nominal GDP (Y) is employed as a substitute (T).

Then,

Where Y is nominal GDP. Velocity is constant in the short run. PY is nominal income.

MV is aggregate expenditure.

Graphically, Fisher's equation of exchange can be represented as shown in the figure.

Money quantity is retained at the x-axis, with the price level and money value kept on the Y-axis. The blue color line slopes above, indicating that prices rise as the amount of money available for transactions rises. The downward-sloping nature of the black-colored curve below indicates that as money's supply rises, money's value falls.

Criticism of Fisher's Transaction Approach

- This theory takes money as an exchange medium, but it also serves as a store of value and a unit of measurement.

- This theory fails to take into account other factors that influence price level in addition to the supply of money, such as population, saving, investment, etc.

- This theory is static because it treats several variables as constant, whereas, in fact, they change with time.