Consumption in Economics

Using up products and services is the act of consumption. We all eat things that are a regular part of life and keep us healthy and satisfied. We eat to maintain and enjoy our lives. We incorporate our ideas into creation after consuming someone else's ideas.

The purpose of this article is to provide a comprehensive overview of consumption, the consumption function, types of consumption, and the psychological law of consumption.

The utilization of resources is the act of consumption. It is sometimes referred to as depletion or usage. Consumption is often referred to as the use of manufactured goods and services, but it can also relate to natural resources like water or coal. The amount of a good or service that households, governments, corporations, and other nations utilize is sometimes referred to as consumption.

Economics defines consumption as spending on quality goods and services to achieve emotional and physical well-being.

In other words, consumption is purchasing and using things and services to meet current human needs and wants.

It is the use of economic resources to meet current human needs and wants. Consumer goods and services are those that are bought to be consumed. While some durable consumer goods are nonperishable and utilized over an extended period, others are perishable and used immediately.

Concept of Consumption Function

The consumption function, also known as the Keynesian consumption function, is a concept proposed by John Maynard Keynes that describes the relationship between income and consumption. It states that as a person's income increases, their consumption will also increase, but not proportionally. The consumption function is represented by a positively sloped line, showing that as income increases, consumption also increases.

The correlation between consumption and income is known as the consumption function. It demonstrates how much money people spend rather than put aside or reinvest. The consumption function is the functional relationship between total consumption and total income. It shows how consumption expenditure varies with the given change in income. There is a positive relationship between consumption and income which means the higher the income, the higher will be the consumption, and vice versa. The consumption function is also known as the propensity to consume.

The consumption function is expressed as follows:

: C = f(Yd)

where Yd is the amount of disposable income, and C is consumption.

According to the equation above, consumption is a function of income, meaning that as output rises, so does consumption. Because rising income results in rising consumption, this line's slope is positive (i.e., the higher the income more will be the expenditure). This suggests that a decline in output will result in a decline in the demand for products and services.

The consumption function can also be written algebraically as

C = a + b Yd

Where a is autonomous consumption, b is the marginal propensity to consume (0<MPC<1), and b Yd is the induced consumption.

According to the consumption function mentioned above, total consumption is the result of adding induced and autonomous consumption.

Induced consumption refers to consumption influenced by the level of income, whereas autonomous consumption refers to consumption at a zero income level. In other words, induced consumption depends on income level, whereas autonomous consumption is not affected by it.

Types of Consumption Function

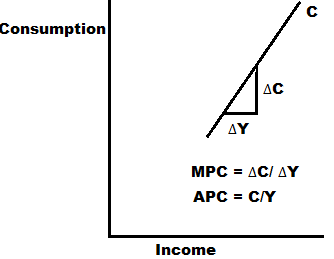

Average inclination to consume and marginal propensity to consume are the two components of consumption function or propensity to consume.

The Average Propensity to Consume

The average pregnancy to consume is the ratio of aggregate consumption and income. It is calculated by dividing expenditure by income. It tells us the level of conjunction at a given level of income.

Symbolically,

APC = C/Y

Where APC is the average propensity to consume

C is consumption, and Y is the level of income.

The consumption function is a graphical representation of the relationship between income and consumption. It shows how much consumers will spend on goods and services as their income rises, up to some maximum level. The slope of the curve measures the marginal propensity to consume (MPC).

As income increases, the average propensity to consume will decrease. It is because consumption increases less than proportionate to the increase in income.

The consumption function is usually represented graphically, with income (Y) on the horizontal axis and consumption (C) on the vertical axis. The slope of the line also called the marginal propensity to consume (MPC) is the amount by which consumption changes in response to a change in income. The MPC is always positive and less than 1, which means that as income increases, people will consume a portion of that increase and save the rest.

The point where the consumption function intersects the Y-axis represents autonomous consumption, which is the level of consumption that takes place independently of income. The difference between total consumption and autonomous consumption is induced consumption, which is the consumption that is induced by changes in income.

The consumption function forms the cornerstone of the Keynesian theory of consumption, which states that consumption depends on income. The theory suggests that changes in income will lead to changes in consumption, but the increase in consumption will not be proportionally equal to the increase in income as people will save some of the extra income they receive.

The consumption function is a key concept in macroeconomics, as it helps to explain the behavior of aggregate consumption, which is the total consumption of all households in the economy, and how it responds to changes in aggregate income.

Marginal Propensity to Consume

Marginal propensity to consume is defined as the ratio of changing consumption to the change in income. It shows how much total consumption changes when there is a change in income by one unit. It is calculated by dividing the change in consumption by the change in income.

Symbolically,

MPC = ∆C/ ∆Y

Where MPC is the marginal propensity to consume, ∆C changes in consumption, ∆and Y is the change in income.

Properties of MPC

1. MPC is greater than zero but less than 1. The value of MPC is always greater than zero because consumption expenditure increase with increasing income and less than 1 because proper node increasing consumption is less than proportionate increase in income. This property is expressed by JM Keynes in his psychological law of consumption.

2. MPC of the poor is greater than the MPC of the rich. This is because of the fact that poor people spend a greater percentage of their income on consumption while rich people spend a smaller percentage of their income. The needs of rich people are already fulfilled but the needs of poor people remain unsatisfied. Therefore, poor people tend to spend larger incomes on consumption.

3. The short-run MPC is stable. It is because the psychological and institutional factors on which the propensity to consume depends do not change in a short time.

Psychological Law of Consumption

The psychological law of consumption is a concept proposed by John Maynard Keynes that describes the relationship between income and consumption. It states that as a person's income increases, their consumption will also increase, but not proportionally. The idea is that people will save some of the extra income they receive, and not spend all of it.

The psychological law of consumption, commonly referred to as the Keynesian psychological law of consumption, was proposed by JM Keynes. The link between income and consumption serves as the fundamental tenet of this law. It costs the type of functional relationship between income and consumption. This rule states that people prefer to spend more on consumption when their income rises, but not to the same amount as the income growth because they save some of their money. The fundamental psychological principle of consumption, states that there is a general tendency for people to spend more on consumption when income increases, but not to the same amount as the increase in income because some of the money is retained. Society frequently spends more and saves more as income rises.

The assumption behind psychological law is as follows.

Institutional and psychological factors will not change: Only income will influence consumption among the factors influencing consumption. other factors such as income distribution, population, price, fashion, Desire, and behavior do not change. these factors are related to human psychology.

For the application of this law, there must be a normal situation and no extraordinary circumstances such as war, revolution, natural disasters, hyperinflation, etc.

Laissez-faire capitalism is a capitalist economy: There should be a capitalist economy to apply this law. A socialist economy cannot apply this law.

The following assumptions serve as the foundation for Keynes' psychological law of consumption:

According to Keynes' law, income largely determines consumption, and income recipients never spend their entire rise in income on consumption.

A community's consumer expenditure will rise along with its overall income, though less proportionately.

Thus, a rise in income will result in an increase in both savings and consumption. This indicates that we can only sometimes anticipate a decrease in total consumption or total savings with a rise in communal income.

Savings typically increase when income increases and savings decline when income declines.

During the early phases of an income gain or fall, savings will increase or decrease at a faster rate than in the latter stages.

To illustrate this concept, Keynes used a graph with income (Y) on the horizontal axis and consumption (C) on the vertical axis. The consumption function is represented by a positively sloped line, which shows that as income increases, consumption also increases. However, the slope of the line is less than 1, which indicates that the increase in consumption is not proportional to the increase in income. Here, the 45-degree line represents the equality between consumption expenditure and income at all levels of income.

The slope of the line also called the marginal propensity to consume (MPC) is the amount by which consumption changes in response to a change in income. The MPC is always positive and less than 1, which means that as income increases, people will consume a portion of that increase and save the rest.

The point where the consumption function intersects the Y-axis represents autonomous consumption, which is the level of consumption that takes place independently of income. The difference between total and autonomous consumption is induced consumption, which is the consumption induced by changes in income.

This theory explains that the level of consumption depends on the level of income and that changes in income will lead to changes in consumption. However, the increase in consumption will not be proportionally equal to the increase in income, as people will save some of the extra income they receive.